2025 ASHT Update - Same or Similar L Code Denials

(August 2025)

Disclaimer: The American Society of Hand Therapists assumes no responsibility for the practice or recommendations of any member or other practitioner, or for the policies and procedures of any practice setting. The therapist functions within the limitations of licensure, state practice act and/or institutional policy. This endorsement should be utilized with respect to current federal and state legislation on the licensing and regulation of both occupational therapy and physical therapy professions. Therapists should check with their local Medicare Administrative Contractor (MAC) and/or insurance payors to determine if an L code is covered and what is required for coverage (e.g., specific prescription, signed plan of care, etc.).

What is the problem? For many therapy practices, Medicare has denied payment for an orthosis due to it being “same or similar” to another orthosis. The rule applies to all “same or similar” orthoses in a five-year time span, which Medicare defines as the Reasonable Useful Lifetime (RUL) of an orthosis. DME claims are processed via Medicare Administrative Contractors (MACs) in four regional areas across the United States. These denials may occur when billing codes that include a similar body part (e.g., L3933 for a finger orthosis and L3808 for a wrist hand finger orthosis) even though these orthoses serve a different purpose, are for different injuries, etc. This also may occur when the clinic bills for a prefabricated orthosis (e.g., for pre-op or conservative management) and then the client needs a custom orthosis after surgery or if the client’s needs change.

Is this a new problem or what has changed? This is not a new rule for CMS, however recently the MACs began denying “similar” codes. Previously only the exact same code would cause a denial within the 5-year span. Now we are seeing denials for any upper extremity code as they are considering all upper extremity codes as “similar” to each other. This significantly impacts hand and upper extremity therapists.

What are my options if a claim is denied?

- If the orthosis is lost, stolen, or damaged: Use the RA modifier and make sure you document accordingly. The reason for replacement must be documented in the supplier's records and may include a beneficiary statement, police report, fire, or insurance report. You can append the RA modifier with the original claim to potentially avoid the denial.

- If the original orthosis is no longer useful or does not serve the correct purpose for the client: Make sure to clearly document the change in the client’s needs for this new orthosis. Please be sure to indicate why the other orthosis would not work in this situation. Your documentation should also include: the beneficiary’s diagnosis, prognosis, duration of condition, functional limitations, clinical course, and past experience with related items. When submitting the redetermination form, the supplier should also submit a standard written order (SWO), proof of delivery, and medical record documentation that indicates a change in medical or physiological condition.

Advance Beneficiary Notice of Noncoverage (ABN): If you believe the claim will be denied regardless of the above solutions, another option would be for the client to sign an ABN. This will mean the client will be responsible for the price of the orthosis. The ABN must be completed prior to providing the orthosis. The ABN must be reviewed with the beneficiary or his/her representative and any questions raised during that review must be answered before it is signed. The ABN must be delivered far enough in advance so that the beneficiary or representative has time to consider the options and make an informed choice. Once all blanks are completed and the form is signed, a copy is given to the beneficiary or representative. In all cases, the notifier must retain a copy of the ABN delivered to the beneficiary on file.

Other helpful tips:

- You can check the MAC website or portal in advance of issuing an orthosis to determine if your patient has received prior L codes in cases where it is unclear or the patient does not remember. NOTE: you can only view claims sent to the MAC you are checking

- You must request a redetermination within 120 days from the date you received the Electronic Remittance Advice (ERA) or Standard Paper Remittance (SPR) Advice that lists the initial determination

- MACs generally issue a decision within 60 days of the redetermination request receipt date. The MAC will inform you of the decision via a Medicare Redetermination Notice (MRN), or if they reverse the initial decision and pay the claim in full, you get a revised ERA or SPR.

- If you disagree with the MAC redetermination decision, you may request a Qualified Independent Contractor (QIC) reconsideration which is considered a second level appeal. You must file a reconsideration request within 180 days of the MRN receipt date. You must make a QIC review request of a MAC dismissal within 60 days of the dismissal notice receipt.

- There are up to five levels in the appeals process

What else can be done on a policy level? What is ASHT doing to help? ASHT, AOTA, and APTA, along with our respective legislative consultants, have been working for years to change the way Medicare views and denies our orthoses. We have had numerus calls and meetings and have collaborated with other impacted groups. CMS is unwilling to try alternatives and has not yet been sympathetic to our efforts. We continue to work together to find a better solution for OT and PT providers as well as Medicare beneficiaries to receive critical access to required medical care in cases of our L code orthotics. For now, we are trying to share the information we do have on appealing denials to ASHT members and in some cases avoiding denials. Please continue to check the Legislative Action Center (LAC) regularly for updates/calls to action, ASHT will continue to advocate for our members and the patients we serve.

Additional Resources

Common Denial Codes and How to Resolve Them: https://med.noridianmedicare.com/web/jddme/topics/ra/denial-resolution

Same or Similar Denials for Orthoses and the Appeals Process: https://med.noridianmedicare.com/web/jddme/policies/dmd-articles/2020/same-or-similar-denials-for-orthoses-and-the-appeals-process

ABN Form Instructions: https://www.cms.gov/Medicare/Medicare-General-Information/BNI/Downloads/ABN-Form-Instructions.pdf

Medicare Redetermination Request Form: https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/downloads/cms20027.pdf

TRICARE Issues?

(May 2025)

Are you having any issues with payment for therapy services from TRICARE? ASHT recognizes the significant challenges that providers are facing with TRICARE's new reimbursement practices. These issues include non-payment of claims, challenges with authorizations and credentialing, or coverage gaps for U.S. service members and their families. ASHT supports the efforts of AOTA and APTA to bring these issues to your congressional representatives and speak up to make sure they are being addressed.

Occupational therapy practitioners affected by the challenges associated with TriWest are encouraged to email AOTA at regulatory@aota.org. Please include as many pertinent details as possible in your correspondence, ensuring that no protected health information (PHI) is disclosed. Please note that because these issues are so widespread, AOTA is unable to assist individual practitioners, but may contact you for clarification or additional detail.

Physical therapists impacted by recent TRICARE contractor issues: Contact your member of Congress ASAP, and urge them to reach out to the Defense Health Agency to fix this disruption and restore operations. APTA members can visit the APTA Legislative Action Center to make their voice heard.

2025 Medicare Physician Fee Schedule

(November 2024)

With the 2025 Medicare Physician Fee Schedule final rule having been recently released (fact sheet may be found here and press release here), we wanted to flag a couple of highlights as they pertain to ASHT’s comments on the proposed rule:

- Perhaps most notably, CMS did finalize its proposed changes to the signature requirements for certification of Therapy Plans of Care (see discussion beginning on page 549)

- OTA/PTA Supervision: CMS also finalized its proposal to change Medicare Part B supervision requirements for OTA/PTA from direct supervision to general supervision (see discussion beginning on page 542)

- Caregiver Training Services: CMS also finalized its proposal to establish new coding and payment for caregiver training along with the proposal to allow consent for Caregiver Training Services to be provided verbally by the patient (or representative)

- Unfortunately (but not surprisingly), CMS finalized its proposed conversion factor reduction of 2.83% for 2025.

- We continue to closely monitor congressional developments surrounding this issue – note that Congressman Greg Murphy’s staff thanked us for ASHT’s support of the Medicare Patient Access and Practice Stabilization Act, and you will see ASHT listed as an endorsing organization in the press release announcing introduction of the measure..

2023 ASHT Update - Compact Act 2

(January 27, 2023)

The Therapy Compact is a formal agreement between states to improve access by facilitating interstate practice of both occupational and physical therapy services. This is accomplished by increasing the mobility of eligible therapists to work in multiple states. The goal is to improve public access to therapy services while preserving the regulatory authority of the states. In addition, public health and safety are protected through state licensure laws.

Below are provisions of the Occupational Therapy Compact Act and frequently asked questions:

https://otcompact.org/wp-content/uploads/2020/10/Final_OT-Compact-Section-Summary.pdf

https://otcompact.org/wp-content/uploads/2020/10/Final_OT-Compact-FAQ.pdf

Frequently asked Physical Therapy questions regarding the Compact Act can be found on the following link:

https://ptcompact.org/Resources-News/FAQ

To identify the states participating in the Compact Act you can use

OT state look up tool

https://otcompact.org/compact-map/

PT state look up tool

https://ptcompact.org/ptc-states

Check with your state for details and here is more information from AOTA

https://www.aota.org/advocacy/issues/ot-licensure-compact

2022 ASHT Update - Same or Similar L Code Denials

(August 2, 2022)

What is the problem? For many therapy practices, Medicare has denied payment for an orthosis due to it being “same or similar” to another orthosis. The rule applies to all “same or similar” orthoses in a five-year time span, which Medicare defines as the Reasonable Useful Lifetime (RUL) of an orthosis. DME claims are processed via Medicare Administrative Contractors (MACs) in four regional areas across the United States. These denials may occur when billing codes that include a similar body part (e.g., L3933 for a finger orthosis and L3808 for a wrist hand finger orthosis) even though these orthoses serve a different purpose, are for different injuries, etc. This also may occur when the clinic bills for a prefabricated orthosis (e.g., for pre-op or conservative management) and then the client needs a custom orthosis after a surgery or if the client’s needs change.

Is this a new problem or what has changed? This is not a new rule for CMS, however recently the MACs began denying “similar” codes. Previously only the exact same code would cause a denial within the 5-year span. Now we are seeing denials for any upper extremity code as they are considering all upper extremity codes as “similar” to each other. This is a significant impact to hand and upper extremity therapists.

What are my options if a claim is denied?

- If the orthosis is lost, stolen, or damaged: Use the RA modifier and make sure you document accordingly. The reason for replacement must be documented in the supplier's records and may include a beneficiary statement, police report, fire, or insurance report. You can append the RA modifier with the original claim to potentially avoid the denial.

- If the original orthosis is no longer useful or does not serve the correct purpose for the client: Make sure to clearly document the change in the client’s needs for this new orthosis. Please be sure to indicate why the other orthosis would not work in this situation. Your documentation should also include: the beneficiary’s diagnosis, prognosis, duration of condition, functional limitations, clinical course, and past experience with related items. When submitting the redetermination form, the supplier should also submit a standard written order (SWO), proof of delivery, and medical record documentation that indicates a change in medical or physiological condition.

Advance Beneficiary Notice of Noncoverage (ABN): If you believe the claim will be denied regardless of the above solutions, another option would be for the client to sign an ABN. This will mean the client will be responsible for the price of the orthosis. The ABN must be completed prior to providing the orthosis. The ABN must be reviewed with the beneficiary or his/her representative and any questions raised during that review must be answered before it is signed. The ABN must be delivered far enough in advance that the beneficiary or representative has time to consider the options and make an informed choice. Once all blanks are completed and the form is signed, a copy is given to the beneficiary or representative. In all cases, the notifier must retain a copy of the ABN delivered to the beneficiary on file.

Other helpful tips:

- You can check the MAC website or portal in advance of issuing an orthosis to determine for sure if your patient has received prior L codes in cases where it is unclear or the patient doesn’t remember. NOTE: you can only view claims sent to the MAC you are checking

- You must request a redetermination within 120 days from the date you received the Electronic Remittance Advice (ERA) or Standard Paper Remittance (SPR) Advice that lists the initial determination

- MACs generally issue a decision within 60 days of the redetermination request receipt date. The MAC will inform you of the decision via a Medicare Redetermination Notice (MRN), or if they reverse the initial decision and pay the claim in full, you get a revised ERA or SPR.

- If you disagree with the MAC redetermination decision, you may request a Qualified Independent Contractor (QIC) reconsideration which is considered a second level appeal. You must file a reconsideration request within 180 days of the MRN receipt date. You must make a QIC review request of a MAC dismissal within 60 days of the dismissal notice receipt.

- There are up to five levels in the appeals process

What else can be done on a policy level? What is ASHT doing to help? At the moment, there is nothing that we are able to change on a policy level. ASHT along with its legislative consultants and the AOTA and APTA and their legislative consultants have been working for years to change the way Medicare views and denies our orthoses. We’ve had many calls and meetings and have collaborated with other impacted groups. CMS is unwilling to try alternatives and has not yet been sympathetic to our efforts. We continue to work together to find a better solution for OT and PT providers as well as Medicare beneficiaries to receive critical access to required medical care in cases of our L code orthotics. For now, we are trying to share the information we do have on appealing denials to ASHT members and in some cases avoiding denials.

Additional Resources

Common Denial Codes and How to Resolve Them: https://med.noridianmedicare.com/web/jddme/topics/ra/denial-resolution

Same or Similar Denials for Orthoses and the Appeals Process: https://med.noridianmedicare.com/web/jddme/policies/dmd-articles/2020/same-or-similar-denials-for-orthoses-and-the-appeals-process

ABN Form Instructions: https://www.cms.gov/Medicare/Medicare-General-Information/BNI/Downloads/ABN-Form-Instructions.pdf

Medicare Redetermination Request Form: https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/downloads/cms20027.pdf

2023 Physician Fee Schedule Proposed Rule: Medicare Payment Coalition Sign-on Letter

With the release of the 2023 Physician Fee Schedule Proposed Rule, ASHT has joined more than 100 healthcare provider organizations in urging Congress to prevent reimbursement cuts slated to go into effect January 2023: Medicare Payment Coalition Sign-on Letter.

The sign-on letter also reiterates that the Medicare payment coalition would like to work with Congress to explore reforms that will promote long-term stability and remove the need to continue asking Congress for short-term funding patches as has been the case for the past few years.

View the Medicare Payment Coalition Sign-on Letter

Practice Division Update - Additional Payment Edits for DMEPOS of Custom and Prefabricated Orthoses

(June 2021)

CMS regulations require Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) suppliers to operate their business and furnish Medicare-covered items in compliance with all applicable federal and state licensure and regulatory requirements. Claims for items furnished by personnel who are not licensed/certified orthotists or prosthetists by the state in which they practice will be denied. The following states require a licensed/certified orthotist or prosthetist to furnish orthotics or prosthetics: Alabama, Arkansas, Florida, Georgia, Illinois, Iowa, Kentucky, Mississippi, New Jersey, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, Tennessee, Texas, and Washington.

In these 17 states where a licensed/certified orthotist or prosthetist must provide prosthetics and orthotics, suppliers can only bill Medicare for prosthetics and certain custom-fabricated orthotics when physicians, pedorthists, physical therapists, occupational therapists, orthotics personnel, and prosthetics personnel furnish them. The following specialties shall bill for Medicare services when state law permits such entity to furnish a prosthetic or orthotic item:

- Physical Therapist – Specialty Code 65

- Occupational Therapist – Specialty Code 67

Effective for dates of service on or after October 1, 2021, if a supplier is located in one of the applicable states and wishes to bill Medicare for the prosthetics and custom fabricated orthotics r10801otn.pdf (cms.gov) it must properly enroll with the NSC (palmettogba.com) to ensure the correct specialty code(s) is on file.

Practice Division Update - CMS Updates Summary

(March 2021)

General Updates

The 2021 CMS therapy “threshold” amount for physical therapy (PT) and speech therapy combined is $2,110 (up from $2,080 in 2020). Occupational therapy (OT) has an additional $2,110 limit (up from $2,080 in 2020). Monthly Part B premium $148.50, Part B deductible $203. The targeted medical review process (called the Medical Record threshold amount) remains at the $3,000 threshold (no change from last year).

Therapy students have always been allowed to document with restrictions, but CMS clarified that therapy students may now document in the medical record as long as it’s reviewed and verified (signed and dated) by the treating therapist.

Physical and occupational therapists may now officially delegate the performance of maintenance therapy services, when appropriate, to a physical therapy assistant or an occupational therapy assistant.

Updated ABN required as of 1/1/2021 Link for new ABN

Payment Reduction

Congress reduced a scheduled 9% reimbursement cut for 2021 to around 3.2%. Changes in RVU’s increase E/M visit codes, while treatment codes reduced. Many healthcare professional organization including ASHT are still working to fight to eliminate this reduction in the future.

CMS changes in Response to Public Health Emergency (PHE)

The leniency that was implemented during COVID-19 has been extended to allow “direct supervision” (as defined by each state practice act) to be provided using real-time, interactive audio and video technology (not including phone) through the end of 2021. What this means is if one was previously required to provide direct supervision on site, now one may comply via technology.

The “proof of delivery” signature requirement is waived by CMS for DME. Documentation should be placed in the medical record stating date of delivery and that the signature could not be obtained.

CMS did not require accreditation for newly enrolled DMEPOS providers, and expired supplier accreditation was extended for 90 days.

DME MACs were allowed the flexibility to waive replacement requirements for DME. However, the claim must include a narrative description from the supplier as to why a replacement was warranted (lost, stolen, irreparable damage).

Telehealth

The PHE includes extending many OT and PT codes to be billed through telehealth visits (ex. 97110) through April 1, 2021. After the PHE is expired, telehealth services have also been extended (still not permanently approved) and allowed until the end of 2021, but only using certain codes. It is recommended to check with your local state telehealth laws and individual payers to ensure you are following their specific guidelines.

G2250-Remote assessment of recorded video and/or images submitted by an established patient, including interpretation with follow up with the patient within 24 business hours, not originating from a related service provided within the previous 7 days nor leading to a service or procedure within the next 24 hours or soonest available appointment.

G2251-Brief communication technology-based service, e.g. virtual check-in, by a qualified health care professional who cannot report evaluation and management services, provided to an established patient, not originating from a related e/m service provided within the previous 7 days nor leading to a service or procedure within the next 24 hours or soonest available appointment; 5-10 minutes of medical discussion.

98970-Qualified non-physician healthcare professional online digital assessment and management service, for an established patient, for up to 7 days, cumulative time during the 7 days; 5-10 minutes

98971-Qualified non-physician healthcare professional online digital assessment and management service, for an established patient, for up to 7 days, cumulative time during the 7 days; 11-20 minutes

98972-Qualified non-physician healthcare professional digital assessment and management service, for an established patient, for up to 7 days, cumulative time during the 7 days; 21 or more minutes

Quality Payment Program (MIPS)

- Low-volume threshold criteria for 2021: (must meet all three criteria, however, group participation may make an individual eligible if the individual clinician does not meet these criteria)

-Bill more than $90,000 Part B charges under physician fee schedule

-Provided care to greater than 200 Medicare Beneficiaries.

-Provided 200 or more eligible professional services. - Four significant scoring changes: changes to the performance threshold & category weight, discontinuation of APM scoring standard and made changes to scoring hierarchy

- Performance Threshold has been set at 60 points for 2021 (increased from 45 points 2020)

- Additional Performance Threshold: 85 points to earn additional incentives

- MIPS 2021 Category Weights-Quality: 40%, Cost: 20%, Improvement activities: 15% (CMS has a list, collect and use patient satisfaction scores, engage patients in developing POC, etc.), Promoting Interoperability: 25% (PTs and OT are automatically accepted, data does not have to be submitted for this category, however, final scores may be re-weighted)

- APM: improvement activities 20%, quality 50%, and promoting interoperability 30%

- CMS Web interface discontinued in 2022

- Date enrolled as Medicare Provider: Providers excluded if they enrolled as a provider after January 1, 2021

- If you don't report in 2021 but are eligible, it is possible to face a -9% penalty against 2023 Medicare payments

- MIPS value pathways will not start until at least 2022 due to delays from the ongoing pandemic

- For 2021, the complex patient bonus has been doubled for the 2020 performance period (from 5 to 10 points)

2021 performance period and 2023 payment impact

0-15% points = -9% payment adjustment

15.01 to 59.99 points = payment adjustment between 0% to -9%

60 points/performance threshold = neutral adjustment 0%

60.01 to 84.99 points = Positive payment adjustment - Scaling factor used to meet budget neutrality requirements

85 to 100 points = positive payment adjustments and additional positive payment adjustment based on funding pool.

2020 MIPS measure #221: Functional Status Change for Patients with Shoulder Impairments

2020 MIPS measure #222: Functional Deficit: Change in Risk-Adjusted Functional Status for Patients with Elbow, Wrist or Hand Impairments

2020 MIPS measure #318: Falls: Screening for Future Fall Risk

NCCI Edits for Therapy Services Reinstated - Effective October 1, 2020

(October 28, 2020)

CMS has reinstated changes to the National Correct Coding Initiative (NCCI) edit pairs. These changes went into effect October 1, 2020. Earlier this year, there was confusion on this topic as there were changes and reversals, and retroactive application. Hand and upper extremity therapists across the country who use some of these codes have experienced these changes and reversals.

Beginning October 1, 2020, the 59 modifier should be affixed when billing certain codes with evaluation codes and other commonly used CPT codes. The 59 modifier indicates that the two codes being billed are separate and distinct.

Below are some highlights related to hand and upper extremity therapy:

- The change affects OT and PT evaluation codes. OT and PT evaluation codes form edit pairs with the code for manual therapy techniques but can be billed with the 59 modifier. OT and PT evaluation codes are edited against 97750, 97755, 97763 and considered mutually exclusive and therefore cannot be billed with a modifier.

- OT and PT re-evaluation codes (97168 and 97164) are edited against 97750, 97755 and 97763 as mutually exclusive and therefore cannot be billed with a modifier.

For more detail and information

California Medi-Cal Budget Cuts

(June 2, 2020)

COVID-19 Government, Reimbursement & Regulatory Update

(March 31, 2020)

Submitted by: ASHT Leadership and ASHT's Legislative Consultant

Following swift passage in the House and Senate, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act (P.L. 116-136) into law on March 27. The legislation represents an unprecedented $2 trillion stimulus measure to combat the coronavirus and stabilize the nation’s economy.

The package marks the third bill passed in recent weeks to address the crisis. There is wide acknowledgement that more action will be needed in the coming months to sustain the fight and buoy the economy. ASHT is working with lawmakers, the Administration and the federal agencies to ensure you are able to continue delivering needed therapy services. We are also focused on measures that can help hand therapists navigate this fluid environment and for those whose practices have been disrupted.

We have identified a number of provisions that may be relevant to you:

1. Health Care Provisions

Section 3703. Expanding Medicare Telehealth Flexibilities:

This provision enables beneficiaries to access telehealth, including in their home, from a broader range of providers, in hopes of reducing COVID-19 exposure. Under this section, the Department of Health and Human Services now has broad authority to waive restrictions on telehealth services, including on physical and occupational therapy services across health settings. This is a critical step in ensuring that hand therapists can continue delivering needed services during this time.

In addition, the Trump Administration unveiled a range of temporary regulatory waivers and new rules, last night, to equip the American healthcare system with maximum flexibility to respond to Novel Coronavirus (COVID-19) pandemic.

As part of its efforts, CMS is allowing more services to be delivered via telehealth to new or established patients. Providers can also waive Medicare copayments for these telehealth services. CMS indicated in its summary that clinicians can now provide the following additional services by telehealth - Therapy Services, Physical and Occupational Therapy, All levels (CPT codes 97161- 97168; CPT codes 97110, 97112, 97116, 97535, 97750, 97755, 97760, 97761, 92521- 92524, 92507).

Additional action by CMS may be necessary, however, before OTs and PTs can bill the above referenced code for telehealth. Please check back; we will be updating you on this important development as soon as we get clarity.

Section 3711. Increasing Medicare Access to Post-Acute Care:

This section provides acute care hospitals flexibility, during the COVID-19 emergency period, to transfer patients out of their facilities and into alternative care settings in order to prioritize resources needed to treat COVID-19 cases. Specifically, this section waives the Inpatient Rehabilitation Facility (IRF) three-hour rule, which requires that a beneficiary be expected to participate in at least three hours of intensive rehabilitation at least five days per week to be admitted to an IRF. It allows a Long Term Care Hospital (LTCH) to maintain its designation even if more than 50 percent of its cases are less intensive. It also temporarily pauses the current LTCH site-neutral payment methodology.

Section 3712. Preventing Medicare Durable Medical Equipment Payment Reduction:

This section prevents scheduled reductions in Medicare payments for durable medical equipment, which helps patients transition from hospital to home and remain in their home, through the length of COVID-19 emergency period.

Section 3715. Providing Home and Community-based Support Services during Hospital Stays:

This section allows state Medicaid programs to pay for direct support professionals, caregivers trained to help with activities of daily living, to assist disabled individuals in the hospital to reduce length of stay and free up beds.

2. Small Business Relief

Are you self-employed, operate your own practice, or small business? The CARES Act expands existing eligibility requirements and provides greater funding opportunities for businesses seeking relief from the federal government under two Small Business Administration Loan programs. Under the SBA 7(a) program, businesses are eligible to borrow up to $10 million with significant loan forgiveness if the funds are used for payroll, lease payments and other general expenses. Under the disaster assistance program, businesses are eligible to borrow up to $2 million. This chart compares the salient aspects of both the SBA 7(a) loan program and the disaster assistance program.

3. Unemployment

Section 2102. Pandemic Unemployment Assistance:

This section creates a temporary Pandemic Unemployment Assistance program through December 31, 2020 to provide payment to those not traditionally eligible for unemployment benefits (self-employed, independent contractors, those with limited work history, and others) who are unable to work as a direct result of the coronavirus public health emergency.

Section 2104. Emergency Increase in Unemployment Compensation Benefits:

This section provides an additional $600 per week payment to each recipient of unemployment insurance or Pandemic Unemployment Assistance for up to four months.

4. Individual & Household Relief

Section 2201. 2020 recovery rebates for individuals:

All U.S. residents with adjusted gross income up to $75,000 ($150,000 married), who are not a dependent of another taxpayer and have a work eligible social security number, are eligible for the full $1,200 ($2,400 married) rebate. In addition, they are eligible for an additional $500 per child. This is true even for those who have no income, as well as those whose income comes entirely from non-taxable means-tested benefit programs, such as SSI benefits.

5. COVID Response Packages I & II

The CARES Act builds on provisions passed in the first two COVID-19 response measures, including the following items aimed at providing relief to small businesses:

Paid Sick Leave Tax Credit for Employers:

The Families First Coronavirus Act (“FFCA”) generally requires most employers with under 500 employees to provide up to 10 business days of paid sick leave. The law provides qualifying employers a refundable payroll tax credit equal to 100% of the total wages paid on these additional sick days. These credits will generally apply to the employer’s portion of its Social Security taxes. The credit is limited to $511 per day ($5,110 total) if taking time off to care for themselves or $200 per day ($2,000 total) to care for (1) an individual who’s quarantined; (2) showing symptoms of COVID-19; or (3) a minor child whose school is closed.

Paid Sick Leave Tax Credit for the Self-Employed:

The FFCA also provides for a similar credit to self-employed taxpayers as it provides qualifying employers, except the credits are taken against the taxpayer’s income tax and are refundable to the extent they exceed the taxpayer’s tax liability.

Family Leave Tax Credit for Employers:

The FFCA generally requires most employers with under 500 employees to provide public health emergency leave under the Family and Medical Leave Act when an employee cannot work because they must care for a minor whose school or care provider is closed or unavailable due to a coronavirus emergency as declared by a Federal, State, or local authority. The FFCA requires employers to provide at least two-third of the employee’s usual pay up to $200 per day, or a total of $10,000. Employers receive a refundable credit that is equal to qualified family leave amount to be used against its share of payroll taxes for each employee.

Family Leave Tax Credit for the Self-Employed:

A similar family leave credit is also available for self-employed taxpayers. The refundable credit is used to offset the taxpayer’s income tax liability and is equal to 100% of the qualified leave amount.

Tax Filing Date Extension:

All businesses have until July 15, 2020, to file their tax returns and make any necessary payments without interest or penalties.

6. Stay Up to Date:

Guidance for many of these provisions will be rolling out from the federal agencies in the coming days and weeks. Please continue to monitor our site for updates and resources on this critical topic.

Practice Division Update- CMS QPP-MIPS relief during COVID-19

(March 2020)

Submitted by: Ekta Pathare, FACHE, MBA, OTR, CHT, ASHT Practice Division Director

CMS has announced relief for clinicians, hospitals and facilities participating in QPP in response to COVID-19. The QPP-MIPS deadline is extended from March 31.2020 to April 30, 2020. MIPS eligible clinicians unable to submit data by April 30’2020 will qualify for automatic extreme and uncontrollable policy and receive a neutral payment adjustment for 2021 MIPS payment year.

Practice Division Reimbursement Update

(March 2020)

Submitted by: Ekta Pathare, FACHE, MBA, OTR, CHT, ASHT Division Director

Aetna expands its policy for tele-health and COVID-19 testing visits.

For billing information providers should visit:

APTA provides guidelines regarding inclusion of PT for e-visits by CMS, Aetna and CDC guidelines during the global emergency caused by COVID-19 to ensure providers and patients stay safe.

CMS has issued a blanket waiver for lost, destroyed, irreparably damaged, or otherwise unusable DMEPOS, contractors can now waive replacement requirements such as face to face requirement, a new physician order, medical necessity documentation. A narrative description on the claim is still required explaining the reason the equipment must be replaced, lost or destroyed as a result of the emergency. Visit the CMS link for details.

Practice Update: CMS and Telehealth during the COVID-19 Crisis

(March 2020)

Submitted by: Danielle Sparks, DHS, MOT, OTR, CHT

President Trump has broadened access to Medicare telehealth services so beneficiaries receive a wider range of services from healthcare professionals without having to travel to a facility.

Telehealth is the exchange of medical information from one site to another through electronic communication to improve a patient’s health.

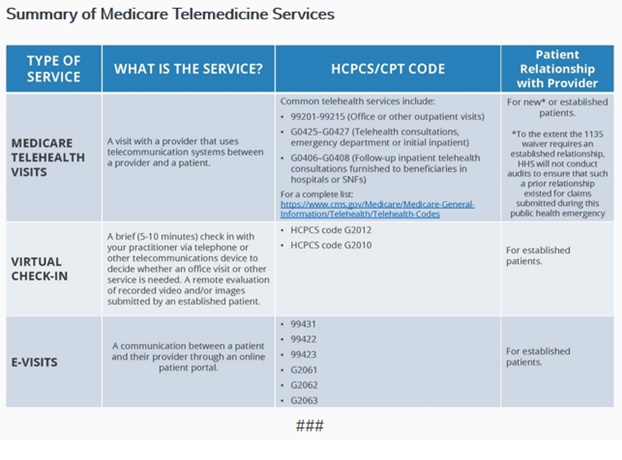

There are three types of visits: Medicare telehealth visits, virtual check-ins and e-visits. All three are being allowed for rural and non-rural areas. The patient must be an established patient, coinsurance and deductible would apply abd patient must agree to these services, but providers may educate patient on this service availability prior to consent.

Medicare telehealth visits: Must be video AND audio that permits real-time communication, and bills at same rate as in-person visits through Medicare.

Virtual check-in (brief communication technology-based service): Can be via a number of communication technology modalities including synchronous discussion over the phone or exchange or information through video or image. Communication cannot be related to medical visit in prior seven days and cannot lead to a visit 24 hours after.

G2012: 5-10 minute discussion with established patient

G2010: remote evaluation and recorded video and/or images submitted by established patient

E-visits: patient portal used to communicate

Therapy codes include:

G2061: online assessment and management 5-10 minutes

G2062: online assessment and management 11-20 minutes

G2063: online assessment and management 21+ minutes

Practice Update: ASHT Members Beware: Read the Fine Print on TPA Checks

(March 2020)

Submitted by: Camerion Judge, MS, OTR/L, CHT

The American Physical Therapy Association (APTA) put out a member alert in early March with the subject being “suspect ‘checks’ are making the rounds.” (March 11, 2020-PTinMotion online bulletin).

These ‘suspect’ checks have been sent out to various therapy providers, from a national proprietary provider network, under the guise of payment for services rendered when, in fact, they are a scheme being used to entrap unwitting therapy providers into participating in that network.

According to the APTA, the fine print, written directly on the check, states: “depositing this check constitutes acceptance of network participation, and acceptance and agreement of all terms and conditions of the agreement.” Endorsing and depositing these ‘suspect’ checks completes the contractual agreement.

The APTA is not releasing the name of the specific entity employing such a calculated tactic. They are, in general, urging therapists and their billing staff to thoroughly examine any checks received from what looks like a third-party administrator, or TPA.

If any ASHT members have encountered or experienced a similar situation, please contact our Advocacy Committee, or any ASHT volunteer. The better we communicate within our networks, the sooner we can prevent additional business harm.

Practice Update: Recent CMS CCI Hard Edits

(January 2020)

CMS has reversed the recent CCI hard edits due to large-scale advocacy of our partner therapy organizations APTA and AOTA. This reversal will be extended to the claims beginning January 1, 2020. CMS is still working on its internal processes to implement this reversal, which is expected to take some time.

CMS had originally issued CCI hard edits to prevent simultaneous billing of therapeutic activities (97530) or group therapy codes (97150) along with therapy evaluation codes.

For more information, please visit the National Correct Coding Initiative (NCCI) Edits Reversal and CMS intends to walk back a decision to change coding methodologies.

Practice Update: Medicare "Same" or "Similar" Orthotic Denials

(January 2020)

Dear ASHT members,

We want to assure you that we are taking these developments very seriously.

In response to growing concerns in recent months, representatives from ASHT, in partnership with the American Physical Therapy Association (APTA), The APTA Academy of Hand and Upper Extremity Rehabilitation and the American Occupational Therapy Association (AOTA), met with CMS officials in Baltimore on November 27, 2019, to address the increased incidences of coverage denials for custom-fabricated and pre-fabricated orthoses as well as audits requesting recoupment from prior years.

The meeting with CMS generated a number of follow up items. With guidance from past leadership of ASHT, thermoplastic manufacturers and OTS support manufacturers, APTA Hand Academy have prepared a response that has been sent for review to ASHT and AOTA.

Per CMS’ representatives' request, APTA, ASHT and AOTA sent a joint letter to the DME MAC medical directors requesting a meeting regarding this issue. As expected, they declined as the policy is not based on Local Coverage Determinations but is a national policy falling under the authority of CMS. We anticipate additional meetings with CMS going forward.

Please know we are working diligently to address this issue from every angle and appreciate you sharing your concerns. Your examples provide critical evidence for our case against these harmful denials.

We will be sure to provide updates regarding our progress with CMS and its contractors very soon.

ASHT Leadership team and Legislative Consultant

Practice Update: Therapy's Role in Pain Management

(January 2019)

A newly released draft report from the Pain Management Best Practices Inter-Agency Task Force identifies occupational and physical therapists' critical roles in managing chronic pain and highlights a number of important concepts and recommendations, including:

- Multidisciplinary approaches to pain management, such as:

- Restorative movement therapies (e.g. PT, OT, massage and aqua therapy)

- Complementary approaches (e.g. acupuncture, yoga, tai chi)

- Behavioral health interventions (e.g. coping skills, cognitive behavioral therapy)

- Using a biopsychosocial model of care

- Individualized and client-centered care

- Improved access to care for individuals who are experiencing pain

- Use and create innovative approaches to pain management such as telehealth and new medical devices

- Conduct research to better understand pain and preventative measures for chronic pain

- Prescribe opioids in a safer way by understanding the client’s medical, social, and family history

ASHT plans to submit comments on the draft report in regards to the role that OTs and PTs play in pain management approaches. We also encourage you to visit our Legislative Action Center to share your own experiences, or email the U.S. Department of Health and Human Services on hand therapists’ role in pain management at paintaskforce@hhs.gov.

Opioid Crisis Response Act of 2018 (H.R. 6) - Bill Signing

(October 26, 2018)

This week, President Donald Trump signed into law the Substance Use-Disorder Prevention that Promotes Opioid Recovery and Treatment (SUPPORT) for Patients and Communities Act (H.R. 6). The new law represents the culmination of an intense year-long legislative effort to stem the opioid crisis.

During the debate, ASHT emphasized with lawmakers the importance of helping people find non-opioid alternatives to managing their pain, including hand therapy. We are pleased that the final agreement adopted a number of key policies that could benefit the hand therapy profession and the clients you serve, including provisions that would:

Direct CMS to issue guidance to states for treating and managing Medicaid beneficiaries’ pain through non-opioid pain treatment and management options, including coverage and reimbursement recommendations.

Require the Secretary of HHS to submit a report on ways to improve reimbursement and coverage for multi-disciplinary, evidence-based non-opioid chronic pain management.

Require the Secretary of HHS to develop guidance and a toolkit on pain management and opioid use disorder prevention for hospitals receiving payment under Part A of the Medicare program.

Update the scope of the Interagency Pain Research Coordinating Committee to identify, among other things, advances in pain care research supported or conducted by the federal government, including information on best practices for the utilization of non-pharmacologic treatments.

Incentivize the treatment of individuals with substance use disorders by establishing a loan repayment program for eligible health care professionals working in shortage areas or counties that have been hardest hit by drug overdoses.

The hard work, however, has just begun. The agencies will soon initiate the rulemaking process, develop parameters for incentivizing non-pharmacological treatments, and examine critical reimbursement incentives. With that in mind, ASHT is preparing to engage CMS and other key agencies as they seek input in the coming months. We will continue to keep you updated on any new developments.

2019 Medicare Physician Fee Schedule

(October 2018)

On September 10, 2018, ASHT submitted a letter to the Centers for Medicare and Medicaid Services (CMS) in response to the proposed 2018 Medicare Physician Fee Schedule and related policies included in the proposed rule.

View the full letter here

Opioid Crisis Response Act of 2018 (H.R. 6)

(September 2018)

The Senate is poised to consider comprehensive legislation aimed at addressing the nation’s opioid crisis. Please contact your Senator today.

The Opioid Crisis Response Act of 2018 (H.R. 6) represents a critical step in Congress’s year-long effort to advance meaningful policies to address substance use disorders. The bill seeks to address the opioid crisis by providing key tools and resources aimed at better identifying and treating individuals with substance use disorders. H.R. 6 recognizes the importance of promoting non-opioid alternatives to pain management, including the contributions of rehabilitation and therapy.

The bill includes a number of relevant policies for Hand Therapists including provisions that would:

- Direct the Department of Health and Human Services (HHS) to study ways to improve access to non-opioid pain management treatments, including therapy and rehabilitation.

- Seek stakeholder input to develop guidance on pain management and opioid use disorder under part A of the Medicare program

- Update pain care programs to include alternatives to opioid pain treatment and by promoting non-addictive and non-opioid pain treatments, and non-pharmacologic treatment.

- Require that the annual Medicare & You handbook for Medicare beneficiaries to educate on non-opioid alternatives for pain management.

- Direct CMS to issue guidance to states for treating and managing pain through non-opioid treatment under Medicaid.

Hand therapists have a crucial role to play in addressing the opioid epidemic. Whether it is following an upper extremity injury, surgery, or helping manage a chronic condition, hand therapists provide safe, quality, and effective pain care management for their clients.

Please continue to help us advocate for the hand therapy profession by sharing your voice and experience with your Senators. Together we can work to shape policy and ensure rehabilitation remains an important part of the comprehensive solution to address the opioid epidemic.

Please call your Senators to urge them to pass comprehensive opioid legislation, and tell them to make therapy and rehabilitation part of the response to our nation’s substance use crisis.

Congress Faces Packed September Work Schedule

Opioid Legislation and Looming Funding Battle Await

(August 2018)

Following House passage of Support for Patients and Communities Act (H.R. 6) in June, the Senate has worked to craft a legislative package of its own with negotiations hitting a key milestone last week. Republican leadership announced at an August 28 press conference that GOP Senators have reached consensus on underlying opioid legislation and hope to bring a bill to the floor shortly upon their return this month. Senate Democrats, led in negotiations by Senator Patty Murray (D-WA), continue to study the proposal and the Senate ultimately will need to reconcile key provisions of its bill with differences in H.R. 6. Yet the two proposals share some elements in common.

Like H.R. 6, the Senate bill would encourage the use of non-opioid alternatives to pain management and would emphasize multi-modal approaches across settings and reimbursement structures. The bill would also seek to expand access to substance use disorder treatment, support research, and prevent drug diversion.

Hand therapists have a crucial role to play in addressing the opioid epidemic. Whether rehabilitating an upper extremity injury, assisting with recovery post-surgery, or helping manage a chronic condition, hand therapists provide safe, quality, and effective pain care management for their clients.

Please call your Senators to urge them to pass comprehensive opioid legislation, and tell them to make therapy and rehabilitation part of the response to our nation’s substance use crisis.

While the House recessed last month, the Senate also considered the Fiscal Year 2019 Labor, Health and Human Services, Education, and Related Agencies (LHHS-ED) appropriations bill. This is Congress’ largest funding bill and has jurisdiction over virtually all federal health care programs. Passage of the LHHS-ED bill is noteworthy, as in recent years, it has served as a magnet for controversial health policy amendments.

The Senate passed this critical spending bill in an 85-7 vote with overwhelming bipartisan support. As passed, the bill would provide significant new investments in our nation’s current health care priorities and represents a departure from President Trump’s proposal to cut $12.5 billion in spending. These new investments include: $5 billion over Fiscal Year 2017 for the National Institutes of Health, $3 billion over Fiscal Year 2017 to combat the opioid crisis, and $2.3 billion over Fiscal Year 2017 to increase college affordability. While the House did not call up its own bill for a floor vote, Representatives on September 4 agreed to combine the LHHS-ED and Defense spending bills and negotiate a final package with the Senate. Some House conservatives objected to withholding a separate vote on LHHS-ED but Republicans generally are optimistic about the bill’s likelihood of passing.

Two upcoming dates add pressure to Congress to reach an agreement on Fiscal Year 2019 spending as well as on opioids legislation: the expiration of current government funding on September 30 and the 2018 midterm elections on November 6. ASHT will continue to keep you updated on these and other key issues as Congress acts in these last weeks of the year.

2019 Medicare Physician Fee Schedule

(July 2018)

The 2019 Medicare Physician Fee Schedule proposed rule is out and will, undoubtedly, impact hand therapy services under Medicare Part B. ASHT is examining these proposals closely with your practice in mind. The following provides an overview of important changes on the horizon for hand therapy:

Functional Limitation Reporting (FLR)

Among the most important and welcoming changes for hand therapists is the proposal by CMS to eliminate FLR. Since 2013, OTs and PTs have been required to assign G-codes to their claims for the purposes of fulfilling CMS’ pursuit of value-based payment. ASHT is pleased that CMS has acknowledged the shortcoming of this data collection and the unnecessary burdens and complexities associated with the documentation mandate.

Quality Payment Program (QPP)

CMS is proposing that OTs and PTs providing services under Medicare Part B join the QPP by participating in either the Merit-based Incentive Payment Program (MIPS) or an Alternative Payment Model (APM) beginning in 2019.

The QPP consists of two participation pathways – MIPS, which measures performance in four categories to determine an adjustment to Medicare payment, and APMs, in which clinicians may earn an incentive payment as well as an exemption from MIPS reporting requirements.

Under MIPS, data is collected in four key areas: quality, resource use, clinical practice improvement activities, and interoperability of electronic health records. These categories are combined to determine your Composite Performance Score. The total score ultimately determines whether providers are eligible for a payment bonus or payment reduction.

While OTs and PTs have not been eligible participants to date, therapists have been allowed to voluntarily report data as a means of gathering feedback in anticipation of eventually being required to meet the program’s reporting requirements.

Low Volume Exemption: MIPS includes an exemption for smaller private practices through a Low Volume Threshold policy. The policy states that if any one (1) of the following applies, the practitioner is not required to report under MIPS: the practitioner has Medicare-allowed charges of less than or equal to $90,000; provides covered services to 200 or fewer beneficiaries; or provides 200 or fewer services to beneficiaries.

Therapy Cap Repeal Implementation

The passage of the Bipartisan Budget Act of 2018 ended the long-fought battle over Medicare’s Part B therapy cap. The repeal of the cap also included a number of additional provisions that are addressed in the recently released MPFS proposed rule, including requirements to continue the use of the KX modifier for claims exceeding $2,010 for OT and for PT and speech-language pathology (SLP) services combined. While affixing the KX modifier is still required, all claims above that threshold will not be subject to review.

Perhaps the most surprising provision in the Bipartisan Budget Act of 2018 was language aimed at OTAs and PTAs. The MPFS addresses this provision by proposing the use of modifiers when PTAs or OTAs are providing outpatient services. Ultimately, the modifiers will be utilized to implement a reduction in reimbursement for OTAs and PTAs. The legislation calls for such services to be paid at 85% of the fee schedule beginning in 2022. Voluntary reporting could begin as soon as 2019, according to the proposed rule. ASHT has significant concerns with this proposal and will be exploring legislative and regulatory remedies to reverse this policy.

U.S. House of Representatives Passes Opioid Legislation

(June 29, 2018)

Last week, the House of Representatives passed H.R. 6: Support for Patients and Communities Act, a critical step toward passing comprehensive opioid legislation in the 115th Congress.

The bill seeks to address the opioid crisis by providing key tools and resources aimed at better identifying and treating individuals with substance use disorders. Importantly, H.R. 6 recognizes the importance of promoting non-opioid alternatives to pain management, including the contributions of rehabilitation and therapy.

Among many key provisions, the SUPPORT for Patients and Communities Act (H.R. 6) would:

- Direct the Department of Health and Human Services (HHS) to study ways to improve access to non-opioid pain management treatments, including therapy and rehabilitation.

- Seek stakeholder input to develop guidance on pain management and opioid use disorder under part A of the Medicare program.

- Convene technical expert panels aimed at reducing surgical and post-surgical opioid use.

Hand therapists have a crucial role to play in addressing the opioid epidemic. Whether it is following an upper extremity injury, surgery, or helping manage a chronic condition, hand therapists provide safe, quality, and effective pain care management for their clients.

As attention now turns to the Senate to act, please continue to help us advocate for the hand therapy profession by sharing your voice and experience with your Members of Congress. Together we can work to shape policy and ensure rehabilitation remains an important part of the comprehensive solution to address the opioid epidemic.

Please contact your Senators to urge them to pass comprehensive opioid legislation, and tell them to make therapy and rehabilitation part of the response to our nation’s substance use crisis.

Be heard: Visit the ASHT Legislative Action Center

Opioid crisis takes center stage as Congress prepares for upcoming Memorial Day recess

(June 1, 2018)

Congress continues to take aim at the opioid epidemic with hopes of passing a comprehensive legislative package before lawmakers leave for August recess. Across the political spectrum, members of Congress recognize the importance of alternative treatments for pain. As hand therapists, your daily efforts to minimize client pain and maximize function offers a true alternative to opioids, and Congress agrees!

Last week, the House Ways and Means Committee approved the Medicare and Opioid Safe Treatment (MOST) Act (H.R. 5776) with overwhelming bipartisan support. Among other things, H.R.5776 would require the Secretary of Health and Human Services to examine avenues to improve access to services such as cognitive behavioral interventions, physical therapy, occupational therapy and physical medicine.

The House Energy and Commerce Committee was also busy at work last week, approving 57 bills over a marathon two-day markup. Included among the bills was the Medicare Opioid Safety Education Act (H.R.5685), which seeks to bolster educational resources available to Medicare and Medicaid beneficiaries on pain management and alternative pain management treatments, like therapy. Bills like H.R.5776 and H.R.5685 represent prime opportunities for hand therapists to highlight the benefits of rehabilitation. We anticipate that the House could vote on a combined package of opioid bills as early as June 11.

Meanwhile in the Senate, the HELP Committee considered and approved S.2680: The Opioid Crisis Response Act of 2018, while the Senate Finance Committee followed suit with a legislative package consisting of 22 bipartisan policy proposals. The Senate hopes to bring the complement of bills to the Senate floor in the coming month for full consideration.

Members of Congress are currently back home this week for Memorial Day “recess,” and it’s a perfect time to let them know what you do, how you help your clients and how therapy and rehabilitation are vital solutions to the opioid epidemic. Your voice and experience are a critical piece of the puzzle. In fact, we've even created a member survey so we can capture your experiences and better educate lawmakers. Please take time to tell your story. As you have conversations with members of Congress back home, be sure to let ASHT know so we can reinforce your message when members return to Congress in June.

ASHT Pain Management Survey

As Congress continues to consider legislation to address the opioid epidemic, ASHT wants to hear from you!>

We want your voice and experience to resonate in this broader debate as ASHT continues to monitor these developments and work to shape policy to address the opioid epidemic. Knowing how you have helped clients manage chronic and acute pain through therapy and rehabilitation is a critical piece of the solution to this nationwide crisis.

Thank you for taking the time to complete this brief survey examining the role hand therapists play in battling the opioid epidemic. The information gathered may be used and presented to physicians, insurers and legislators by ASHT.

Congress Considers Legislation to Address the Opioid Epidemic - Hand Therapy Part of the Solution

(May 1, 2018)

Over the past few months, we’ve seen a flurry of debate on Capitol Hill around the opioid epidemic. This week marked the first significant steps taken this year toward advancing comprehensive legislation on this critical topic.

On April 24, the Senate Committee on Health, Education, Labor and Pensions (HELP) marked up S.2680: The Opioid Crisis Response Act of 2018. This bipartisan bill was a combination of 40 different policy proposals, cobbled together over seven bipartisan hearings on how to best address the opioid crisis. The Opioid Crisis Response Act of 2018 aims to accomplish many items, including:

- Require the Secretary of HHS to provide technical assistance related to the use of alternatives to opioids, including for common painful conditions and certain patient populations, such as geriatric patients, pregnant women and children.

- Spur development and research on of non-addictive painkillers, and other strategies to prevent, treat and manage pain and substance use disorders through additional flexibility for the NIH.

- Support the healthcare workforce by providing resources for pain care providers to assess, diagnose, prevent, treat and manage acute or chronic pain, as well as for the detection of early warning signs of opioid use disorders.

The Senate HELP Committee advanced S.2680 unanimously by a vote of 23-0. Chairman Lamar Alexander (R-KY) expressed his hopes that the full Senate will move the opioid legislation by this summer.

On April 30, the House Energy and Commerce Health Subcommittee concluded their opioid markup, advancing 56 opioid related bills to the full Energy and Commerce Committee. This full docket, comprised of introduced bills and draft legislation, offered a broad range of solutions to the crisis, across the areas of public health, behavioral health and Medicare and Medicaid reimbursement. According to Chairman Burgess (R-TX), the full committee markup is likely to take place in mid-May.

Among the drafts to advance was the Adding Resources on Non-Opioid Alternatives to the Medicare Handbook, which would direct CMS to compile educational resources for beneficiaries regarding opioid use, pain management and alternative pain management treatments. The legislation goes on to instruct CMS to include these resources in the “Medicare and You” handbook. Legislation like this gives ASHT the opportunity to emphasize the benefits of therapy as well as the work you do as therapists to minimize client pain and maximizing function.

As Congress continues to consider legislation like this to address the opioid epidemic, we want to hear from you! Knowing how you have helped clients manage chronic and acute pain through therapy and rehabilitation is a critical piece of the solution to this nationwide crisis.

We want your voice and experience to resonate in this broader debate as ASHT continues to monitor these developments and work to shape policy to address the opioid epidemic. Share your personal experiences, stories, and background to asht@asht.org, so we can tell Congress that Hand Therapy is part of the solution.

Hand Therapy Practice and the Opioid Epidemic (April 6, 2018)

Hand therapists have a crucial role to play in addressing the opioid epidemic. Whether it is following an upper extremity injury, surgery, or helping manage a chronic condition, hand therapists provide safe, quality, and effective pain care management for their clients.

In recent months, Washington has turned its attention to the opioid epidemic, providing nearly $4 billion in new spending in the recent funding bill and debating dozens of bills to address the multi-faceted crisis. When Congress returns from recess next week, lawmakers will seek to continue the momentum.

On April 11th, the House Energy and Commerce Committee will hold a legislative hearing to examine a new slate of bills aimed at curbing opioid use by, among other things, addressing Medicare and Medicaid coverage barriers, tracking opioid prescribing patterns, requiring drug companies to alter packaging, and allowing providers to write smaller prescriptions. In addition, the Centers for Disease Control and Prevention and now Blue Cross Blue Shield are actively advocating for a new standard that emphasizes non-opioid alternatives as the first line of treatment for pain management over opioid prescribing.

As the debate unfolds over the coming months, ASHT will continue to educate lawmakers about the important role hand therapists play in safe, effective pain management. ASHT will also be emphasizing the importance of non-opioid alternatives to pain management and working to improve and support policies that embrace the benefits of therapy and rehabilitation.

Stay tuned to ASHT's Legislative Action Center for updates on this issue.

Victory! Repeal Becomes Law (February 9, 2018)

This morning, February 9th, President Trump signed the latest stopgap funding bill into law, which included the Permanent Repeal of the Medicare Therapy Cap!

Today marks a huge victory for the profession that was twenty years in the making. As a member of the American Society of Hand Therapists, we wanted to thank you, sincerely, for your steadfast commitment to addressing this critical issue. You have lent your voice to this cause many times, and today, your emails and phone call were finally heard. Today, we can finally say, “The Medicare Therapy Cap is repealed!”

As we look to the future, we recognize that this victory is one part of a larger journey to ensure people have access to therapy services and ultimately a chance at functioning fully. We must now look to continue seeking improvements through the rulemaking and implementation phases of this permanent repeal. Your voice will be vital to this process as we find the best path forward for the profession.

Thank you for all of your support and congratulations on a job well done!

For more information on the new law, visit our Legislative Action Center

Medicare Therapy Cap (February 7, 2018)

Swift action in the House of Representatives this week has brought full and permanent repeal of Medicare's outpatient therapy cap one giant step closer to reality. Since 1997, ASHT and its allies in the therapy community have fought long and hard to repeal this harmful and arbitrary cap on Medicare beneficiary care. Our chance for victory is now!

On Monday evening, House negotiators unveiled a spending package aimed at avoiding another government shutdown and quickly readied it for consideration. The measure would extend government funding at current levels through March 23rd and address a slate of expired Medicare 'extender' policies, including a permanent solution to Medicare's outpatient therapy cap. Following debate yesterday afternoon, the House passed the bill last night by a margin of 245-182.

In addition to immediately repealing the therapy cap, the language codifies the targeted review mechanism as well as the use of the KX modifier after a threshold of $3,000. In exchange for these changes and the corresponding costs associated with repealing the cap, negotiators included an offset that would reduce payment for therapy assistant (OTA and PTA) services beginning in 2022 to 85% of what is currently reimbursed. In the remaining time before the Senate considers its version, ASHT will work with its allies in the therapy community to advocate for an alternative offset.

With the Senate poised to make changes, it's critical your Senators hear from you today. We need your help to ensure this giant step forward in the House is indeed a path to victory. Please contact your senators today and urge them to permanently repeal the therapy cap.

Medicare Access to Rehabilitation Services Act (January 24, 2018)

After a weekend of wrangling, the House and Senate reconvened this past Monday and agreed to end its shutdown stalemate. Ultimately, Congress approved an amended continuing resolution (CR) that reopened the government and extended funding through Feb. 8th. The agreement also reauthorized and funded the popular Children's Health Insurance Program (CHIP) for six-years and delayed a number of ACA-related tax provisions imposed on medical devices, high-cost health plans, and health insurers.

With some of our nation’s frailest seniors projected to hit the cap later this month and the Centers for Medicare and Medicaid Services (CMS) currently holding claims for physical, speech, and occupational therapy, we are quickly reaching an untenable situation. It’s critical that our voice resonate above the noise and negotiations of Washington, especially in the coming days. A bipartisan solution to permanently address the therapy cap exists, and ASHT strongly urges you to reach out to your Members of Congress and call on them to support a permanent solution today!

CMS Proposed Orthotics and Prosthetics Rule Update

CMS has officially withdrawn the proposed orthotics and prosthetics rule (CMS 6012-P) published last January, which would require therapists to be certified in orthotics in order to receive payment for custom-fabricated orthotics for Medicare beneficiaries. Congratulations to all of our members who contributed comments in support of our profession! This victory was only possible because of the effort of every single person who chose to be involved.

For the CMS announcement follow this link: https://www.federalregister.gov/documents/2017/10/04/2017-21425/medicare-program-establishment-of-special-payment-provisions-and-requirements-for-qualified

Medicare Card Number Changes (July 17, 2017)

In an effort to protect Medicare and their beneficiaries from fraud and identity theft, and to protect program and personal information, CMS will be removing Social Security numbers from Medicare cards. Social Security-based Health Insurance Claim Numbers (HICN) will be replaced by a unique, randomly assigned Medicare Beneficiary Identifier (MBI) number.

CMS will begin mailing out replacement cards in April 2018, and the replacement process should be completed by April 2019.

CMS is developing a secure tool for providers to look up MBI numbers at point of service to facilitate this changeover.

Your systems need to be ready to accept the new MBI numbers by April 2018; however, there will be a 21-month transition period during which you can bill patient services using either a HICN or MBI number.

Another Update on Misvalued OT Evaluation Codes (April 14, 2017)

CMS has issued Change Request 9977, which states MACs are not responsible for searching through files to identify misvalued claims, but will adjust those claims brought to their attention retroactive to January 1, 2017. Occupational therapists should contact their individual MACs to determine how to resubmit the underpaid evaluation claims. Learn more

CMS Miscalculated OT Evaluation Code Rates (April 7, 2017)

AOTA discovered that CMS lowered the reimbursement rate on the new tiered occupational therapy evaluation codes due to an error in the amount used for the practice expense portion of the code in some MAC regions. AOTA met with CMS, who has corrected the error in its April Quarterly Update Transmittal and has communicated the correction to the Part B Medicare administrative contractors. The corrected rates should be posted soon and are retroactive to January 1, 2017.

No action is required on the part of providers; however, it is a good idea to keep checking the fee schedule to make sure the correction is put in place. Affected MAC regions should see an increase and receive the retroactive payments in the next months.

Background of Proposed Rule CMS-6012-P (February 6, 2017)

Background: CMS-6012-P

- Establishment of Special Payment Provisions and Requirements for Qualified Practitioners and Qualified Suppliers of Prosthetics and Custom-Fabricated Orthotics

Three pieces of previously passed legislation modifying the Social Security Act of 1935 are the basis for the proposed rule affecting payment for custom-fabricated orthoses (c/f O) and prostheses (P) for Medicare beneficiaries.

The first was precipitated by a report by the Office of Inspector General issued in October 1997 exploring the extent of questionable billing of Medicare for orthotics, which concluded that 19% were medically unnecessary, 68% of unnecessary orthotics were provided by a DME company and 35% by orthotists. (You are correct: This adds up to more than 100%). They also concluded 68% of billed orthoses from SNFs were “questionable” and were typically provided by DME companies. They concluded there was a need to develop guidelines better defining orthoses; distinguish between custom-made and OTS; develop policies for the codes for which they prioritized upper-limb devices identified as being the most problematic; work with American Orthotist and Prosthetist Association to develop a table of devices that should not be used together; and consider stricter standards for identifying who was allowed to bill for orthotics (sic), such as requiring professional credentials for orthotic suppliers. 1

H.R.5661:

Medicare, Medicaid and SCHIP Benefits Improvement and Protection Act of 2000 (BIPA) which became part of Public Law 106-554, adopted in December 21, 2000

- Amended §1834(h)(1)(F): “No payment will be made for c/f O or P unless furnished or fabricated by a qualified practitioner or supplier at a facility that meets criteria the Secretary of Health and Human Services determines appropriate.

- Qualified practitioner is a physician or other individual who is a qualified PT or OT; is licensed in orthotics or prosthetics; in the cases where the state provides such licensing, or in states where the state does not provides such licensing, is specifically trained and educated to provide or manage the provision of prosthetics and custom-designed or fabricated orthotics AND is certified by the ABC or the BOC; OR is credentialed and approved by a program that the Health and Human Services Secretary determines has the training and education standards that are necessary to provide such prosthetics and orthotics.

- Scheduled to go into effect one year after adoption. (December 21, 2000, in effect December 21, 2001)

A committee was established to determine how to enact the law, but the committee was unable to reach consensus by 2003.

Medicare Prescription Drug, Improvement and Modernization Act of 2003 (MMA)

- Added §1834(a)(20): requiring HHS Secretary to implement quality standards for suppliers of items and services including orthotics and prosthetics as a condition of obtaining a DMEPOS supplier number and being reimbursed by Medicare.

- Directed HHS Secretary to designate independent accreditation organizations to enforce the quality standards.

- Established procedures for designation of national accreditation organizations.

The Quality Standards were published in 2006 and 11 accreditation organizations were approved. Presently, nine of those organizations are still active; six are approved for credentialing c/f O and P.

Medicare Improvement for Patients and Providers Act of 2008 (MIPPA)

- Suppliers had to show evidence of accreditation by one of the accreditation organizations.

- HHS Secretary was given the right to exempt “eligible professionals” including qualified OTs, PTs and physicians as well as “Other Persons,” such as orthotists and prosthetists, from the quality standards and accreditation requirements unless the HHS Secretary determined the standards were specifically designed to be applied to the eligible providers and other persons.

- Eligible professionals were identified as ”MDs, PAs, nurse practitioners, certified nurse specialists, anesthetists, certified nurse midwives, clinical social workers, clinical psychologists, PTs, OTs or SLPs.

The exception has been in place for eight years. No new reports have been issued by OIG on Medicare orthoses billing and therefore, no data is available to measure the efficacy of the payment changes on fraudulent billing.

On January 11, 2017, HHS Secretary Sylvia Burwell and CMS’ Acting Director Andy Slavitt released the proposed rule, which was published in the Federal Register on January 12, 2017 with a 60-day comment period.

On January 24, 2017, the current administration issued an executive order directing all federal agencies to stop sending any new regulations to the Federal Register until otherwise directed. Any regulation sent to the Federal Register but not published was ordered to be withdrawn. This had no effect on the proposed rule, which had already been published.2

Rule Summary

- Effective one year from implementation, all practitioners and suppliers billing Medicare for c/f O or P will be required to be accredited by the American Board for Orthotists and Prosthetists Certification (ABC).

- All facilities where any c/f O or P are fabricated must be accredited by ABC.

- All facilities where any c/f O or P are fabricated must have specific equipment.

(click here to view list)

CMS does not believe beneficiary access to care will be significantly affected and the benefit in improved quality of care outweighs any possible discontinuity of care. CMS states the goal is to ensure that the specialized needs of Medicare beneficiaries who require prosthetics and c/f orthotics are met.

- Department of Health and Human Services Office of Inspector General. Medicare Orthotics. October 1997: https://oig.hhs.gov/oei/reports/oei-02-95-00380.pdf (accessed online 1/29/17).

- Federal Register January 24, 2017, 82;14 :8346: https://www.gpo.gov/fdsys/pkg/FR-2017-01-24/pdf/2017-01766.pdf (accessed 1/25/17).

- List of affected orthotics and prosthetics: https://www.cms.gov/Medicare/Provider-Enrollment-and-Certification/MedicareProviderSupEnroll/Downloads/CMS-6012-P_HCPCS_Code_List.pdf (accessed 1/20/17).

- Federal Register January 12, 2017. 82;8:3678-3694: https://www.federalregister.gov/documents/2017/01/12/2017-00425/medicare-program-establishment-of-special-payment-provisions-and-requirements-for-qualified (accessed online 1/16/17).

Assistants and L code Billing (May 31, 2016)